Welcome to Cyborg Finance

The best place to find financial services and information Simpler, clearer, faster

Why choose Cyborg Finance?

A Cyborg is a person whose abilities are extended beyond human limitations. You shouldn't settle on finance for your home.

- No Office Visits Online, Phone & Email.

- Real Humans, Not Robots Talk to a real person - Qualified & Authorised by the FCA.

- Better than your Bank We have 12,000 options for you, not several.

Our Financial Services

-

Home Buyer Mortgage

>

First Time Buyer Guide to buying your own home.

-

Home Mover Mortgage

>

Elevate your move with our tailored Home Mover Mortgage for a smooth transition to your new dream home.

-

Home Owner Remortgage

>

Refinance with our Home Owner Remortgage for better rates, releasing equity, or funding improvements—empowering your homeownership journey.

-

Buy-to-Let Mortgage

>

Dive into property investment with our Buy-to-Let Mortgage, tailored for both seasoned investors and first-timers seeking to build a profitable portfolio.

-

Holiday Let Mortgage

>

Transform your vacation home investment dreams into reality with a Holiday Let Mortgage,

-

Green Mortgages

>

Green Mortgages 🌳 are a new type of mortgage that rewards you for making your home more energy efficient.

-

Bad Credit

>

Mortgages Adverse Credit Mortgages 📉 are for people with a poor credit history.

-

Private Medical Insurance

>

Cut NHS wait times with private medical care and private hospitals.

-

Life Insurance

>

Pay off your mortgage if you or your partner die.

-

Bridging Finance

>

Navigate property transitions seamlessly with our Bridging Finance, offering quick and secure solutions for your short-term financial needs.

-

Auction Finance

>

Secure your auction triumph with Auction Finance, providing the financial backing needed to confidently bid and acquire your desired property.

Why Cyborg Finance and not your bank?

If not us, then use another.

When financing a property purchase or remortgage, you have two routes: a Bank Salesman or a Mortgage Adviser.

We insist your bank is the worst option. Cyborg Finance strives to be the best mortgage advice company. Yet, if you don't choose us, do choose another mortgage adviser.

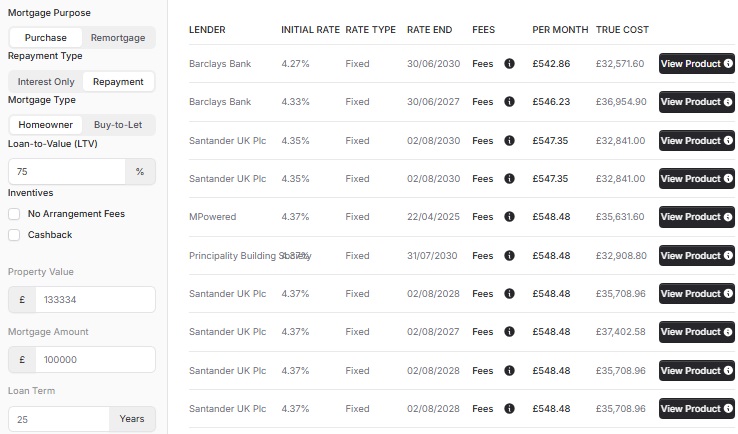

A mortgage adviser has hundreds of mortgage rates a bank has several. A mortgage adviser has 70+ mortgage lender criteria options a bank has one. A bank can take weeks to arrange an appointment, you can apply online with us. Not all mortgage lenders are available to you without a mortgage adviser.

How Can An Independent Mortgage Adviser Help?

Being an independent mortgage adviser is crucial to us. It should be important to you.

A non-independent mortgage adviser (or your bank) can recommend a mortgage based on commercial incentives. They may be tied to a specific mortgage lender or base recommendations on how much the lender pays. Not us.

We are also a whole of the market broker. Cyborg Finance takes a comprehensive view of the mortgage market and not a small panel of lenders. Check the vast list of mortgage lenders we use.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX